Driving the future

of inspections

Making

touchless

inspections

a reality

Built on GeniusAI

01

Engine

Tested & validated AI

damage estimation engine

with over 95%

vehicle coverage

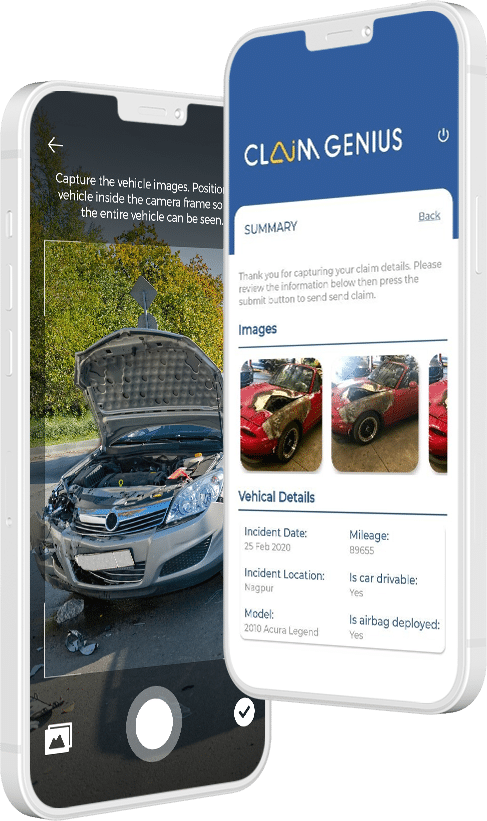

02

App

A white labeled app that

allows users to capture

images & videos

of damaged vehicles

03

Dashboard

Easy and intuitive dashboard

to quickly & efficiently review,

adjust, modify

& approve estimates

04

API

Easy to integrate

API within your

existing

inspection systems

Committed to

deliver impact

We don’t just make tall claims. Our revolutionary solution reflects on your bottom line and your customer satisfaction meter as well. So, here’s the proof of the pudding.

85%

Accuracy for Repair/Replace

50%

Reduction in handoffs

& settlement time

75%

Enhanced photo/video

capabilities

50%

Time and

cost reduction

Partners