Before we begin to understand how the GeniusPREINSPECT Solution can enable pre-inspection automation for you, let us understand the phases of claim settlement. Your insurance passes through 5 phases before your claim can be settled. These are:

- You approach your broker

A broker/agent is an intermediary between you and your carrier. Your broker will assess your situation and then approach the carrier with a plan of action.

- Investigation Commences

Damages/losses are quantified in this stage. An adjuster performs this task, along with determining liable parties. The adjuster will investigate the presence of witnesses, and if any, note down their contact details.

- Policy Review

The adjuster carefully reviews your policy to understand the type of coverage your insurance provides.

- Damage Evaluation

Appraisers, engineers and other experts of the field step in to perform an overall analysis of the damage caused. This stage is crucial to arrive at an amount for reimbursements.

- Payment

The amount decided after Damage Evaluation, plus any unforeseen expenses in lieu of repairs will be settled between you and your carrier.

The Role of GeniusPREINSPECT Solution

GeniusPREINSPECT achieves carrier pre-inspection automation and helps improve speed, efficiency and consistency of carrier underwriting decisions. Our tool comes in handy during Stage 4 enlisted above.

Pre-Inspection reports are prerequisites for insurance carriers before they can draw up an underwritten contract. These reports help the carrier make a fair assessment of the situation. Three scenarios are possible, based on the report:

- Roll Over Cases

The customer shifts from one insurance company to another.

- Break-In Insurance

There are discrepancies in the policy, i.e. break-in policy issuance.

- The vehicle in consideration has external assembled fitments

Fuel fitments like CNG/LPG fitted in vehicle or other accessories such as music systems, navigation panel, rear-end camera. LCD etc. add additional overheads to the underwriting.

Typically, carriers rely on third-party inspection service providers. Choosing the right agency at this point is crucial as the turnaround time determines how fast the carrier can get back to the eager client.

This is where the GeniusPREINSPECT tool enters the scene. It allows carriers to make instant decisions on the insurability of new vehicles using advanced artificial intelligence (AI) damage estimation technology, saving significant processing time and cost.

How does it work?

Our clients simply have to follow the Login link to get to our dashboard. At the login, your credentials (which we will send to you through email) will automatically authenticate and verify your validity.

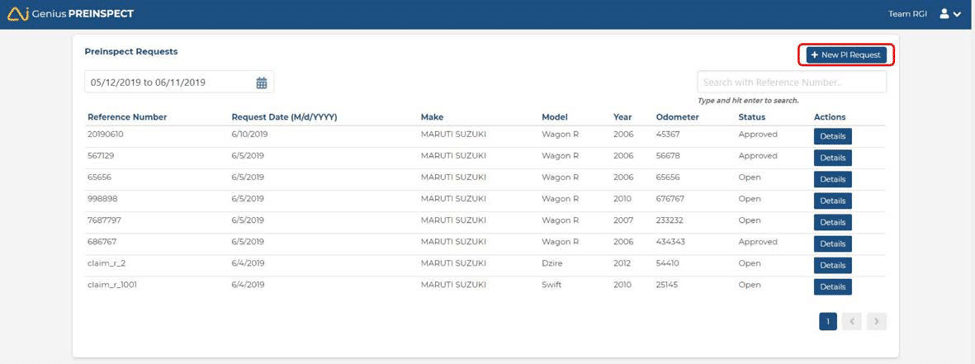

On the main screen, you will see all your requests and an option to initiate a new request.

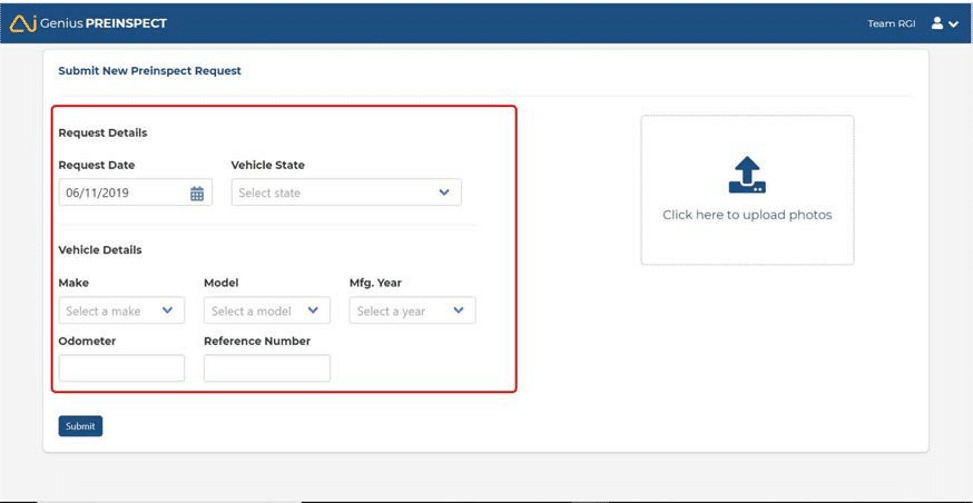

When you opt for creating a new request, you will be taken to a user input form, wherein you will be asked to fill all the relevant details pertaining to the vehicle involved in the accident.

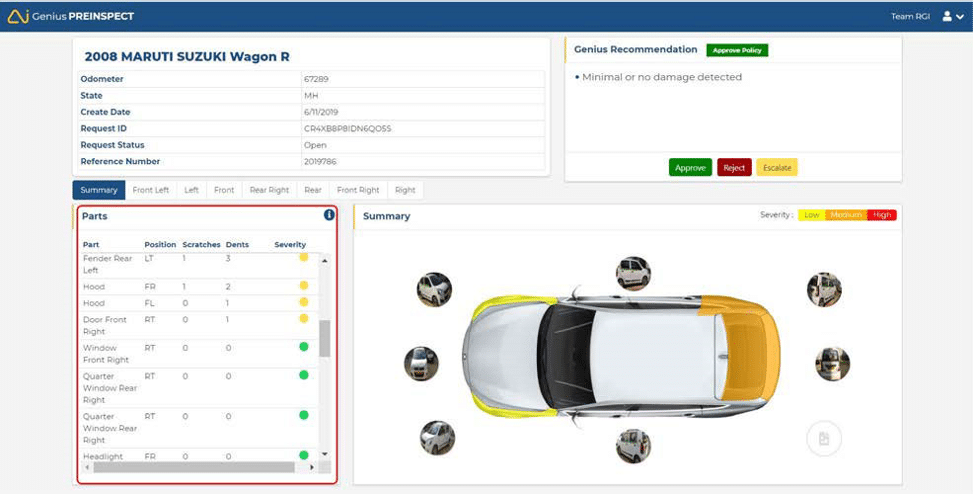

Besides, you have the option to upload a photo of the vehicle. Clicking Submit on this form triggers a process and displays a list of affected Parts. You also get a detailed accompanying graphic highlighting certain parts of a car and flags for the severity of the problem.

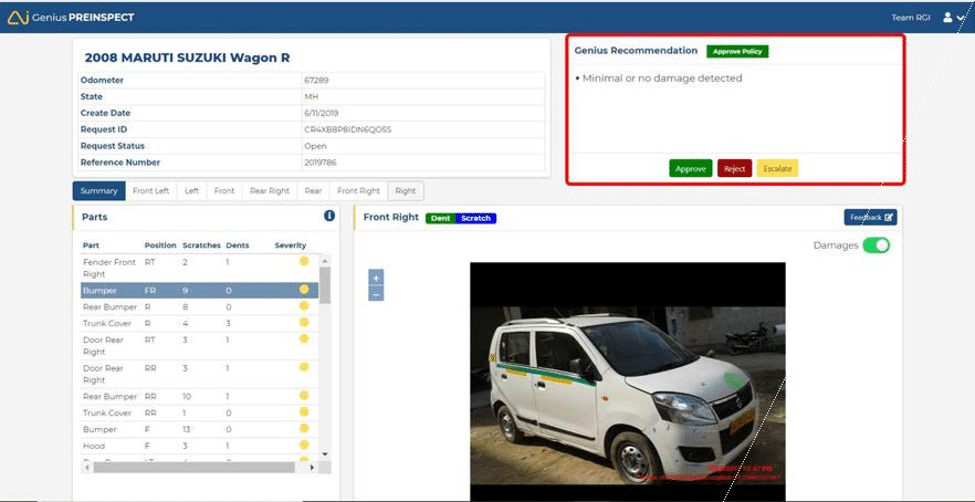

The application shows you a detailed view for each part, whereby our powerful AI can give a complete predictive analysis of the damage incurred. This saves you a lot of time and manual efforts. We have also provided a feature using which you can provide feedback along with the inputs you provide. GeniusPREINSPECT will take those in consideration while evaluating.

Towards the end of the process, our tool will give you recommendations. Based on the suitability for your case, you can approve, reject or escalate your request.

To be competitive in today’s underwriting market, carriers need to provide customers with quick answers on the insurability and costs of new policies, which can often take days if a physical inspection of the vehicle is required. Customers can become frustrated and seek other providers, resulting in a loss of new business. Having an AI-backed highly modernised pre-inspection tool gives you the edge in the industry. If you have any queries about GeniusPREINSPECT, feel free to write to us and we will answer all your doubts.